In today’s global economy, money moves across borders faster than ever—but if your financial tools haven’t kept up, you’re missing out. Whether you’re freelancing for international clients, shopping online from global brands, running a borderless business, or just looking for smarter ways to save, a multicurrency account is no longer a luxury—it’s a necessity.

Let’s explore why a multicurrency account could be your smartest financial move in 2025.

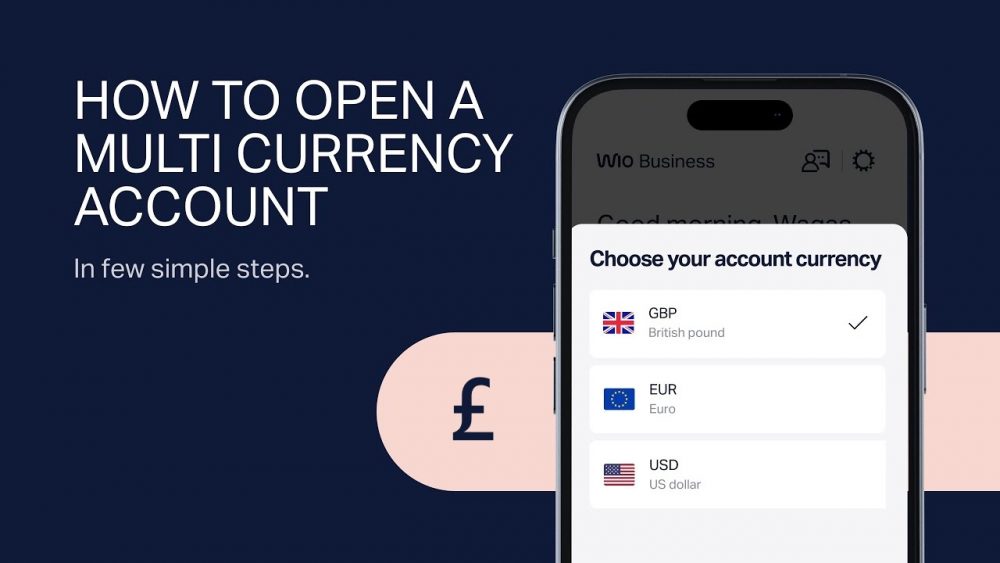

What Is a Multicurrency Account?

A multicurrency account lets you hold, send, and receive multiple currencies—like USD, EUR, GBP, and more—from one central platform. No need for multiple foreign bank accounts or painful currency conversions.

Once exclusive to global corporations, multicurrency accounts are now available to individuals and small businesses thanks to fintech solutions like HelloMe Money.

6 Reasons You Need a Multicurrency Account in 2025

1. You Earn Money Internationally

Remote work is thriving. Developers in Nigeria code for clients in Berlin. Designers in Manila create for brands in New York. But traditional banking still makes it hard to get paid across borders.

A multicurrency account makes it easy.

You can accept payments in foreign currencies without converting right away, giving you more control over exchange rates—and more flexibility to spend globally.

2. Currency Volatility Is a Real Threat

If your local currency is unstable, holding all your funds in one place can be risky. With inflation, devaluation, and economic uncertainty on the rise, your money can lose value overnight.

Multicurrency accounts give you a financial hedge.

Store part of your income in stable currencies like the dollar or euro to protect your purchasing power and plan with confidence.

3. Online Shopping Is Borderless

Shopping from international stores? Subscribing to global platforms? Paying in your local currency often triggers hidden conversion fees and poor exchange rates.

With a multicurrency account, you can pay like a local.

Load your account with the needed currency and enjoy better rates. Virtual dollar or euro cards also make it easier to shop or subscribe securely.

4. Cross-Border Transfers Shouldn’t Be This Hard

Traditional bank transfers are slow, expensive, and outdated. Between wire transfer delays and high fees, sending money internationally is still a hassle for many.

Enter multicurrency transfers.

Send money in minutes with low fees using platforms like HelloMe Money—no wires, no banks, no headaches.

5. You Run a Business in a Global Marketplace

If you’re a business dealing with multiple currencies, you know the challenges: exchange losses, reconciliation issues, and messy accounting.

A multicurrency account simplifies it all.

You can receive payments, hold funds, and choose the best time to convert—streamlining your operations and protecting your bottom line.

6. You Want to Save and Invest Globally

Investing isn’t just local anymore. Whether you’re buying U.S. stocks, crypto, or ETFs from Asia, you often need to deal with multiple currencies.

Multicurrency accounts unlock global investing.

They allow you to fund investments directly in the right currency—saving you money on conversion fees and giving you faster access to opportunities.

Conclusion: The Future of Money Is Multicurrency

From earning and saving to spending and investing, the way we use money has changed. Your bank account should keep up.

A multicurrency account empowers you to live, work, and grow globally—without borders, barriers, or bad exchange rates. And with platforms like HelloMe Money, these tools are now accessible, affordable, and built for emerging markets.

Ready to Think Global With Your Wallet?

Don’t let your money stay stuck in one currency.

Open a multicurrency account with HelloMe Money today and take full control of your financial future.

Start now at HelloMe Money

Leave a Reply